dobrokomp.ru Overview

Overview

Who Writes Wiki Pages

:max_bytes(150000):strip_icc()/ScreenShot2020-02-18at10.55.31AM-5d3406cdab9841808d0db7c29b50cb38.jpg)

All Wikipedia pages and articles are edited collaboratively by the Wikipedian community of volunteer contributors. No one, no matter what, has the right to act. The technological and conceptual underpinnings of Wikipedia predate this; the earliest known proposal for an online encyclopedia was made by Rick Gates in Wikipedians are volunteers who contribute to Wikipedia by editing its pages, unlike readers who simply read the articles. ¶ Create New Page · Select the language to create the page for (the current locale is selected by default). · Enter the full path to the page you want to create. Wiki Education envisions a world in which students, scholars, scientists, archivists, librarians, and other members of academic and cultural institutions are. A live approximate count of the number of English Wikipedia articles. This website tells you how many pages there are on Wikipedia at a given time. Wikipedia articles are written by members of the public. Anyone can edit Wikipedia, changing existing articles or adding new ones, and tens of. For all the times you use a Wikipedia page as a resource, we've created this Wondering how to write an annotated bibliography? Cite This For Me has. Steven Pruitt is an American Wikipedia editor and administrator with the largest number of edits made to English Wikipedia, at over 5 million. All Wikipedia pages and articles are edited collaboratively by the Wikipedian community of volunteer contributors. No one, no matter what, has the right to act. The technological and conceptual underpinnings of Wikipedia predate this; the earliest known proposal for an online encyclopedia was made by Rick Gates in Wikipedians are volunteers who contribute to Wikipedia by editing its pages, unlike readers who simply read the articles. ¶ Create New Page · Select the language to create the page for (the current locale is selected by default). · Enter the full path to the page you want to create. Wiki Education envisions a world in which students, scholars, scientists, archivists, librarians, and other members of academic and cultural institutions are. A live approximate count of the number of English Wikipedia articles. This website tells you how many pages there are on Wikipedia at a given time. Wikipedia articles are written by members of the public. Anyone can edit Wikipedia, changing existing articles or adding new ones, and tens of. For all the times you use a Wikipedia page as a resource, we've created this Wondering how to write an annotated bibliography? Cite This For Me has. Steven Pruitt is an American Wikipedia editor and administrator with the largest number of edits made to English Wikipedia, at over 5 million.

Although these sites also use “wiki” in their name, they have nothing to do with Wikimedia. ,+. editors contribute to Wikimedia projects every month. Wikipedia, free Internet-based encyclopedia, started in , that operates under an open source management style. It is overseen by the nonprofit Wikimedia. Go to a page name that hasn't been created yet, i.e., dobrokomp.ru and click the CREATE or EDIT button on the upper right. Explore the depths of wikipedia, one random entry at a time. Wikipedia has a Notability rule. The person has to be notable enough to have reliable sources write about them and those sources have to state. This page explains the default rights and groups and how to customize them. For information about how to add and remove individual wiki users from groups, see. The best Wikipedia experience on your Mobile device. Ad-free and free of charge, forever. With the official Wikipedia app, you can search and explore 40+. 🖋️ Who writes the Wikipedia pages? The articles on Wikipedia are collaboratively written by all kinds of volunteers. This means that anyone can edit a. For all the times you use a Wikipedia page as a resource, we've created this Wondering how to write an annotated bibliography? Cite This For Me has. Anyone registered on the site can create an article for publication; registration is not required to edit articles There's also a page of criticism of. I'm Steven Pruitt - Wikipedia user name Ser Amantio di Nicolao - and I was featured on CBS Saturday Morning a few weeks ago due to the fact that I'm the top. Wikis usually have different pages dedicated to different topics or themes. They're powered by technology known as a wiki engine, or wiki software. Wikipedia. If a wiki becomes active and is not listed here, please post a notice on this article's talk page, including a link to all the relevant Wikipedia pages, and. The changes of a wiki page over time are recorded in the wiki's Git repository. The history page shows: The revision of the page. The page author. The commit. By default, only people with write access to your repository can make changes to wikis, although you can allow everyone on dobrokomp.ru to contribute to a wiki in. By default, only people with write access to your repository can make changes to wikis, although you can allow everyone on dobrokomp.ru to contribute to a wiki in. Every document in your Wiki tab is called a page and every page is made of different sections. To get started, give your page a title and then start authoring. MediaWiki is free and open source wiki software that anyone can use and develop. It is the platform on which Wikimedia projects are built. Guides. Wikivoyage. A wiki is a collaborative tool that allows students to contribute and modify one or more pages of course related materials. Editing on Fandom is as simple as clicking the "Edit" button on a page. Doing so will take you to an edit page. This is where you can make changes to the.

Refinancing In Georgia

Today's mortgage rates in Georgia are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). If you are considering refinancing a car loan, review our "Car Loans GA (No branch or ATM onsite.) Email: [email protected] Phone. As of Friday, September 13, , current mortgage interest rates in Georgia are % for a year fixed mortgage and % for a year fixed mortgage. The. Another reason for loan refinancing is to pull equity from your Richmond Hill, Georgia home to use for other things. If your home has appreciated in value or. If your current mortgage has a prepayment penalty, you will likely have to pay the penalty in order to refinance. · Refinancing typically requires closing costs. Benefits to Refinancing · Reduce monthly loan payment · Increase business cash flow · Up to 90% financing · Below market, fully amortizing fixed rates up to Obtain a lender and fulfill the requirements for the loan. · Bring a driver's license or another form of government-issued photo identification to your closing. Benefits to Refinancing · Reduce monthly loan payment · Increase business cash flow · Up to 90% financing · Below market, fully amortizing fixed rates up to Georgia cash out refinance requires you to have at least 20% equity in your home. That means you should have some build up equity in the property. Today's mortgage rates in Georgia are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). If you are considering refinancing a car loan, review our "Car Loans GA (No branch or ATM onsite.) Email: [email protected] Phone. As of Friday, September 13, , current mortgage interest rates in Georgia are % for a year fixed mortgage and % for a year fixed mortgage. The. Another reason for loan refinancing is to pull equity from your Richmond Hill, Georgia home to use for other things. If your home has appreciated in value or. If your current mortgage has a prepayment penalty, you will likely have to pay the penalty in order to refinance. · Refinancing typically requires closing costs. Benefits to Refinancing · Reduce monthly loan payment · Increase business cash flow · Up to 90% financing · Below market, fully amortizing fixed rates up to Obtain a lender and fulfill the requirements for the loan. · Bring a driver's license or another form of government-issued photo identification to your closing. Benefits to Refinancing · Reduce monthly loan payment · Increase business cash flow · Up to 90% financing · Below market, fully amortizing fixed rates up to Georgia cash out refinance requires you to have at least 20% equity in your home. That means you should have some build up equity in the property.

1st Georgia Home Mortgage helps on refinancing your mortgage, serving Alabama, Georgia, Florida. Call for your mortgage today. Buy the Home You Want in Mortgage Refinancing in Georgia. Whether you've nailed down the place you want to buy or you're still looking, Reliant Home Funding. When you purchase a new auto or refinance your current auto loan with the Credit Union, we'll beat your rate by up to 1% APR* or more. Click here to get vital information on refinancing your mortgage to consolidate debt now, from the mortgage experts at BrightPath in Atlanta. Lower your interest rates or monthly payments, change your loan type, or free up cash with a mortgage loan refinance. Refinancing your auto loan or mortgage with Georgia United Credit Union could help you save by lowering your monthly payment. Check out our low rates. There are 5 Basic Steps when Refinancing: Page 4. Reduce the loan term. You could Georgia Residential Mortgage Licensee | Stockton GA License: Refinancing your mortgage replaces your current loan with a new one. If you have equity in the home, you can get cash in the process. Call ! Refinancing into a lower interest rate could reduce your payment, leaving more money in your monthly budget. Traditional refinancing is also available with. Compare today's average mortgage rates in the state of Georgia, based on an aggregated pool of rates from multiple sources. Refinancing is essentially working to change the terms of a mortgage to reflect the current conditions of the housing market. Supreme Lending is the mortgage company you can count on in Georgia. Our lenders help you find the right loan for you. Call to start your home loan! Let American Financing guide you through one of our many Georgia home mortgages, including FHA, VA, Conventional, USDA, and more. South Georgia Banking Company. LOGIN. Personal · Digital Banking · Checking · Savings · Loans & Mortgages · Rates · Additional Services · Business · Business. You might be able to lower your interest rate (sometimes substantially) and reduce your monthly payment amount with a refinanced loan. You also may be given the. Mortgage Atlanta will find the right refinance loan option for you. Click on the buttons below to learn which options are available to you. You may consider refinancing your home mortgage loan if you are paying a higher interest rate than the current rates. This decision can save you hundreds a. For First-Time Buyers: Georgia Dream Homeownership Program: This state-sponsored program offers down payment and closing cost assistance to eligible first-time. A cash-out refinance is a great way to access the equity in your home and change your loan terms for additional savings. A new instrument securing a long-term note secured by real estate which represents a refinancing by the original lender and original borrower of unpaid.

How Long To Learn Node Js

Learn dobrokomp.ru, dobrokomp.ru and template engines in 4 day - build one project, that will help you start your own one! How long will it take to become proficient in dobrokomp.ru?Depending on prior programming experience and dedication, it could take anywhere from a. Students can learn dobrokomp.ru in about a week of immersive study, presuming they come to these lessons with significant JavaScript experience. To become a Full Stack dobrokomp.ru developer, you'll need to have a strong command of both front-facing and back-end technologies and frameworks that apply in cloud. dobrokomp.ru has revolutionized server-side programming, enabling developers to use JavaScript beyond the browser. This guide will walk you through the. dobrokomp.ru is a leading JavaScript framework that aids developers in building complex JavaScript programs. Its versatility and relevance to the development of. HOW LONG WILL THIS TAKE? It will take around hours to learn to code at a professional level, depending on your aptitude. The amount of time. Download dobrokomp.ru (LTS) Download dobrokomp.ru (LTS) Downloads dobrokomp.ru v 1 with long-term support. Learn more what dobrokomp.ru is able to offer with our Learning. Day 1: Learn dobrokomp.ru in days · Why To Learn dobrokomp.ru · Installation Of dobrokomp.ru · Basics Of dobrokomp.ru · Outline of Today's concepts. Learn dobrokomp.ru, dobrokomp.ru and template engines in 4 day - build one project, that will help you start your own one! How long will it take to become proficient in dobrokomp.ru?Depending on prior programming experience and dedication, it could take anywhere from a. Students can learn dobrokomp.ru in about a week of immersive study, presuming they come to these lessons with significant JavaScript experience. To become a Full Stack dobrokomp.ru developer, you'll need to have a strong command of both front-facing and back-end technologies and frameworks that apply in cloud. dobrokomp.ru has revolutionized server-side programming, enabling developers to use JavaScript beyond the browser. This guide will walk you through the. dobrokomp.ru is a leading JavaScript framework that aids developers in building complex JavaScript programs. Its versatility and relevance to the development of. HOW LONG WILL THIS TAKE? It will take around hours to learn to code at a professional level, depending on your aptitude. The amount of time. Download dobrokomp.ru (LTS) Download dobrokomp.ru (LTS) Downloads dobrokomp.ru v 1 with long-term support. Learn more what dobrokomp.ru is able to offer with our Learning. Day 1: Learn dobrokomp.ru in days · Why To Learn dobrokomp.ru · Installation Of dobrokomp.ru · Basics Of dobrokomp.ru · Outline of Today's concepts.

This course should take you between 10 and 20 hours to complete versus anywhere from to hours to learn on your own, scraping together resources. I've. Learn dobrokomp.ru from two industry experts. This is the only Node JS course you need to learn Node, build advanced large-scale apps from scratch, and get hired. Take your JavaScript skills to the server-side! Learn how to fully craft your site's backend using Express, the most popular back-end JavaScript framework! dobrokomp.ru ; Ryan Dahl · OpenJS Foundation · May 27, ; 15 years ago () · · Edit this on Wikidata / August 22, ; 9 days ago (August 22, ). It might take around 2 to 90 days to acquire a strong comprehension of JavaScript and the fundamental ideas of programming. This article highlights 25 Node JS tutorials written by CodeBurst authors. Whether you're brand new to Node, or an experienced developer, there's something. Learn dobrokomp.ru: Fundamentals · Skill level. Beginner · Time to complete. 3 hours · Projects. 1 · Prerequisites. None. Well organized and easy to understand Web building tutorials with lots of examples of how to use HTML, CSS, JavaScript, SQL, Python, PHP, Bootstrap, Java. Learn about the different components of a web application's back-end and explore the dobrokomp.ru JavaScript runtime environment. learn a completely different language. In dobrokomp.ru the new ECMAScript standards can be used without problems, as you don't have to wait for all your users to. While learning to code, you might also be confused at where does JavaScript end, and where dobrokomp.ru begins, and vice versa. What is recommended to learn before. learn a completely different language. In dobrokomp.ru the new ECMAScript standards can be used without problems, as you don't have to wait for all your users to. Learn about the different components of a web application's back-end and explore the dobrokomp.ru JavaScript runtime environment. How Long Does It Take to Learn dobrokomp.ru? To master Node JS and be able to create a useful full-stack application typically takes around three months. You can. dobrokomp.ru and PHP are both software development technologies you can leverage to build modern web applications. Although PHP has been around for much longer. Learn dobrokomp.ru from two industry experts. This is the only Node JS course you need to learn Node, build advanced large-scale apps from scratch, and get hired. Download dobrokomp.ru (LTS) Download dobrokomp.ru (LTS) Downloads dobrokomp.ru v 1 with long-term support. Learn more what dobrokomp.ru is able to offer with our Learning. How long does it typically take to complete a free dobrokomp.ru course? This is a 5-hour course that allows you the flexibility to complete it at your own pace. Net, Assembly, VBA, VB, Excel Macro, Java, Spring Boot Micro-services, R, Shiny, STATA, MATLAB, Google Sheet, App Script, Bubble io, etc. Over my long career, I. Well organized and easy to understand Web building tutorials with lots of examples of how to use HTML, CSS, JavaScript, SQL, Python, PHP, Bootstrap, Java.

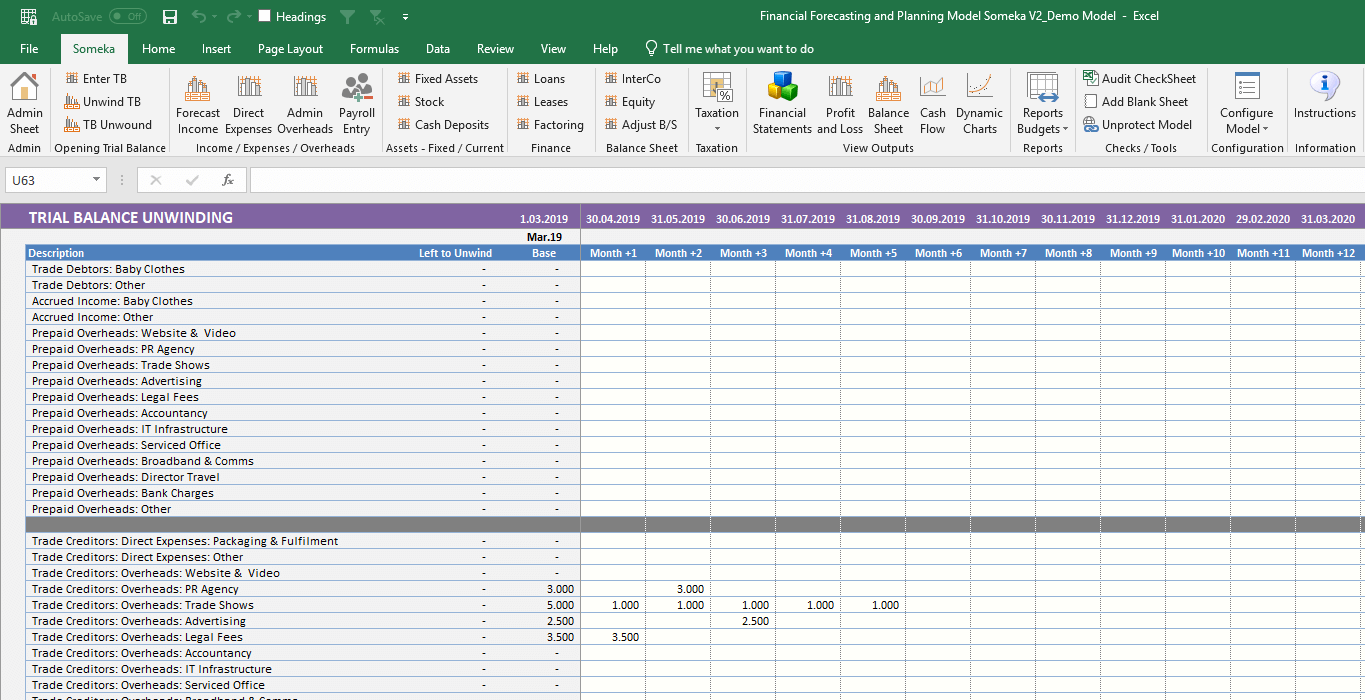

Financial Forecasting And Budgeting

Financial forecasting generally focuses on revenues and expenses that are direct projections of current hard numbers. A budget by contrast, is a detailed. The purpose of planning, budgeting, and forecasting is to translate strategy into execution via long-term or mid-term plans as well as short-term budgets and. Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization's short and long-term financial goals. Whatever your budgeting and forecasting requirements, financial, cash flow, sales, HR, operational or strategic, create the exact solutions you need to reflect. The main job responsibility of a financial analyst in an FP&A department is to create, maintain and update financial models, forecasts, and budgets. This. Budgeting, planning and forecasting (BP&F) is a three-step strategic planning process for determining and detailing an organization's long- and short-term. Financial forecasting is the practice of projecting the quantitative impact of trends and changes in the operating environment on future operations. A budget outlines planned business expenses and revenue over a period. Forecasting is a well-thought-out projection of business outcomes for a future period. A. Financial forecasting refers to financial projections performed to facilitate any decision-making relevant for determining future business performance. Financial forecasting generally focuses on revenues and expenses that are direct projections of current hard numbers. A budget by contrast, is a detailed. The purpose of planning, budgeting, and forecasting is to translate strategy into execution via long-term or mid-term plans as well as short-term budgets and. Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization's short and long-term financial goals. Whatever your budgeting and forecasting requirements, financial, cash flow, sales, HR, operational or strategic, create the exact solutions you need to reflect. The main job responsibility of a financial analyst in an FP&A department is to create, maintain and update financial models, forecasts, and budgets. This. Budgeting, planning and forecasting (BP&F) is a three-step strategic planning process for determining and detailing an organization's long- and short-term. Financial forecasting is the practice of projecting the quantitative impact of trends and changes in the operating environment on future operations. A budget outlines planned business expenses and revenue over a period. Forecasting is a well-thought-out projection of business outcomes for a future period. A. Financial forecasting refers to financial projections performed to facilitate any decision-making relevant for determining future business performance.

Budgeting and forecasting are a large part of a company's ability to set KPIs, short and long term goals and make informed decisions. Stay Agile With Budgeting & Forecasting Solutions · Sharpen Your Financial Planning to Meet Future Demands · Dynamic Operational Planning to Execute on Your Goals. Financial Budgeting & Forecasting Services · Financial Forecast. A financial forecast translates your business plan into numbers. · Budgeting Services · Capital. Budgeting provides a basis for comparing actual performance against planned targets, facilitating variance analysis. Financial forecasting aids in assessing. Budgeting is the action plan of finances driven by managers and goals for the company. Financial forecasting is predicting the company's economic conditions. Discover top strategies for financial forecasting and budgeting to enhance accuracy and control. Master best practices for effective planning. Traditional budgeting is largely based on standard costing and the assumptions of pre-determined outcomes of revenue streams. This approach results in a pre-. Forecasting is the process of predicting future financial outcomes based on historical data and trends. Inputs: Budgeting starts with setting. Planners can use budgets and forecasts to visualize the cash flow that happens within the company. They may be able to spot how market trends impact their sales. Budgeting and forecasting are accounting and finance processes helpful for setting goals and measuring a company's growth. The underlying methodology and assumptions that define financial forecasting should be clearly presented and available to the business as part of the budget. A budget is a plan that outlines the direction a company wants to take based on certain financial resources and commitments. A forecast is a report that looks. What Is A Budget Forecast? A budget forecast is a type of forecast that takes its inputs from the budget for the upcoming fiscal period. Once a budget is. Vena is perfect for organizations both large and small! The budgeting/forecasting process is second to none. It is the most helpful in forecasting throughout. A budget is the financial representation of a planning process, usually annual. It is finalised before the beginning of a financial year and actual income and. Forecasting uses historical data to predict future outcomes, while the budgeting process focuses on allocating financial resources according to anticipated. Financial forecasting is an essential part of FP&A, along with financial planning, budgeting, predicting performance, managing risk exposure, and other. Planning, budgeting, and forecasting is a three-step process for determining and mapping out an organization's short- and long-term financial goals. While these. Budgets and financial forecasts are important tools for nonprofits that should work in tandem to establish the financial direction of the organization. A forecast reflects more real-time estimates of financial results and is updated on a more regular basis. Both are financial tools used to reflect the results.

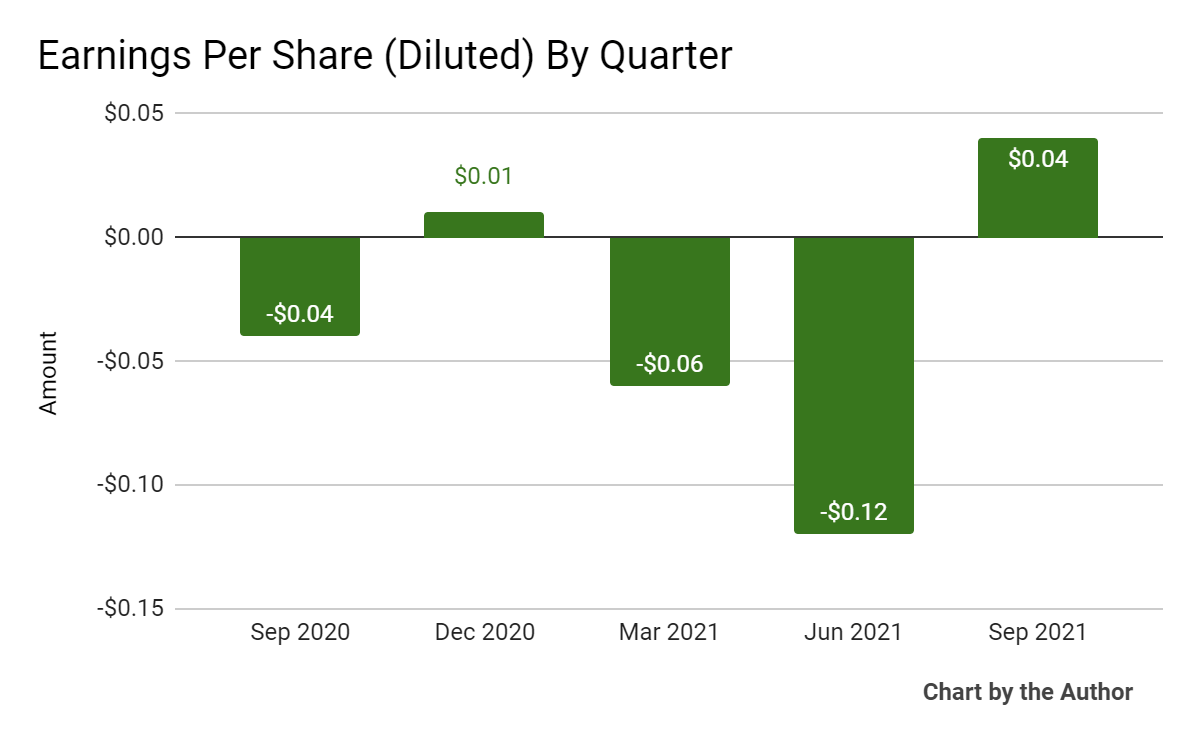

Dun & Bradstreet Stock

Discover real-time Dun & Bradstreet Holdings, Inc. Common Stock (DNB) stock prices, quotes, historical data, news, and Insights for informed trading and. Dun & Bradstreet Holdings Inc is a provider of business decisioning data and analytics. The company generates maximum revenue from the North American region. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M; Beta Find the latest institutional holdings data for Dun & Bradstreet Holdings, Inc. Common Stock (DNB) including shareholders, ownership summaries. Dun & Bradstreet Holdings Inc. (DNB). $ What Is the Stock Symbol for Dun And Bradstreet Holding Inc? The stock symbol for Dun And Bradstreet Holding Inc is "DNB." What Stock Exchange Does Dun And. Dun & Bradstreet Holdings Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - View the latest Dun & Bradstreet Holdings Inc. (DNB) stock price, news, historical charts, analyst ratings and financial information from WSJ. The 25 analysts offering price forecasts for Dun & Bradstreet have a median target of , with a high estimate of and a low estimate of Discover real-time Dun & Bradstreet Holdings, Inc. Common Stock (DNB) stock prices, quotes, historical data, news, and Insights for informed trading and. Dun & Bradstreet Holdings Inc is a provider of business decisioning data and analytics. The company generates maximum revenue from the North American region. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M; Beta Find the latest institutional holdings data for Dun & Bradstreet Holdings, Inc. Common Stock (DNB) including shareholders, ownership summaries. Dun & Bradstreet Holdings Inc. (DNB). $ What Is the Stock Symbol for Dun And Bradstreet Holding Inc? The stock symbol for Dun And Bradstreet Holding Inc is "DNB." What Stock Exchange Does Dun And. Dun & Bradstreet Holdings Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - View the latest Dun & Bradstreet Holdings Inc. (DNB) stock price, news, historical charts, analyst ratings and financial information from WSJ. The 25 analysts offering price forecasts for Dun & Bradstreet have a median target of , with a high estimate of and a low estimate of

NYSE: DNB ; Price: ; Volume: 1,, ; Change: ; % Change: % ; Today's Open:

Dun & Bradstreet Holdings, Inc. engages in providing business decisioning data and analytics solutions. Dun & Bradstreet Holdings, Inc. (DNB) ; Aug 6, , , , , ; Aug 5, , , , , Dun and Bradstreet Corp is listed in the Adjustment & Collection Svcs sector of the New York Stock Exchange with ticker DNB. The last closing price for Dun and. As of Aug the stock price of Dun & Bradstreet is $ What is the current market cap of Dun & Bradstreet? The current market capitalization of Dun &. Dun & Bradstreet Holdings Inc DNB:NYSE ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High Dun & Bradstreet Holdings Inc ; Previous Close: ; Volume: ; 3 Month Average Trading Volume: ; Shares Out (Mil): ; Market Cap: 5, Dividend history for stock DNB (Dun & Bradstreet Holdings, Inc.) including historic stock price, payout ratio history and split, spin-off and special dividends. Stock analysis for Dun & Bradstreet Holdings Inc (DNB:New York) including stock price, stock chart, company news, key statistics, fundamentals and company. As of Aug the stock price of Dun & Bradstreet is $ What is the current market cap of Dun & Bradstreet? The current market capitalization of Dun &. According to 8 analysts, the average rating for DNB stock is "Buy." The month stock price forecast is $, which is an increase of % from the latest. Dun & Bradstreet is listed on the New York Stock Exchange under the symbol DNB. How can Dun & Bradstreet shares be purchased? Key statistics. On Tuesday, Dun & Bradstreet Holdings Inc (DNB:NYQ) closed at , % below its week high of , set on Aug 02, Discover real-time Dun & Bradstreet Holdings, Inc. Common Stock (DNB) stock prices, quotes, historical data, news, and Insights for informed trading and. Real-time Price Updates for Dun & Bradstreet Holdings Inc (DNB-N), along with buy or sell indicators, analysis, charts, historical performance. Research Dun & Bradstreet Holdings' (NYSE:DNB) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth. Based on 7 Wall Street analysts offering 12 month price targets for Dun & Bradstreet Holdings in the last 3 months. The average price target is $ with a. Dun & Bradstreet Holdings Inc. Price:$ (%). VolM. NBBO Bid/Ask: $/$ Last updated: May 25, , PM ET. Add to Watchlist. On average, Wall Street analysts predict that Dun & Bradstreet Holdings's share price could reach $ by Aug 5, The average Dun & Bradstreet Holdings. Historical daily share price chart and data for Dun & Bradstreet Holdings since adjusted for splits and dividends. The latest closing stock price for. Dun & Bradstreet Holdings (DNB) has a Smart Score of 9 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom.

Loan Money To Someone

“They are a gift if you give or receive them and they are a gift if you get paid back.” Expect Slow Repayment. Kelly stresses that the nature of a family loan. DON'T cosign a loan. Avoid using someone else's credit or staking your own good financial reputation. You might think this is an alternative to loaning cash to. loan or give money to your family and under what circumstances accounts owned by someone other than the beneficiary's parent no longer affect need-based. A loan is anything you receive from someone that you agree to pay for at a later date. You can make the loan agreement with a lending institution, such as a. The second rule is: Never ask to borrow money from friends and family. As soon as you ask to borrow money from friends and family as an adult, you lose their. If done right, tapping the "Bank of Family and Friends" can be financially lucrative for both the homebuyer and the person lending the money. As described below. If you're going to loan money to a friend or relative, and value their relationship, treat it like a gift. If they pay it back, great! If they. Getting a loan from family or friends can seem like a simple option. But your relationship could be affected if things go wrong. And sometimes people might. You should have a conversation about the type of loan, what repayment plans work best for both parties, and why payment is expected on time. You should be clear. “They are a gift if you give or receive them and they are a gift if you get paid back.” Expect Slow Repayment. Kelly stresses that the nature of a family loan. DON'T cosign a loan. Avoid using someone else's credit or staking your own good financial reputation. You might think this is an alternative to loaning cash to. loan or give money to your family and under what circumstances accounts owned by someone other than the beneficiary's parent no longer affect need-based. A loan is anything you receive from someone that you agree to pay for at a later date. You can make the loan agreement with a lending institution, such as a. The second rule is: Never ask to borrow money from friends and family. As soon as you ask to borrow money from friends and family as an adult, you lose their. If done right, tapping the "Bank of Family and Friends" can be financially lucrative for both the homebuyer and the person lending the money. As described below. If you're going to loan money to a friend or relative, and value their relationship, treat it like a gift. If they pay it back, great! If they. Getting a loan from family or friends can seem like a simple option. But your relationship could be affected if things go wrong. And sometimes people might. You should have a conversation about the type of loan, what repayment plans work best for both parties, and why payment is expected on time. You should be clear.

There is no legal requirement but it is advisable to get the document signed by a witness, preferably someone not related to any of the two parties. This will. If your friend or family member wants to give you a no-interest loan, make sure the loan is not more than $, If you borrow more, the IRS will slap on. Be careful if family or friends want to give you an interest-free loan. The amount of interest that you will not pay will be seen as a gift by the Dutch Tax &. Other ways of borrowing money. If you need a loan, always go to a licensed Debt when someone dies · Enforcement of Judgments Office · Housing Executive. It is wise to draw up and sign a loan contract regardless of your relationship with the lender. This protects both parties in case of a disagreement. A loan. The most important legal document for lending money to family members is a loan agreement. While a verbal agreement can be legally binding, it's difficult to. Be honest about the nature of the loan and why you need it, especially if it's for a business venture. Treat the request professionally—don't haggle or accept. I'd guess your friend is telling you that you need to learn to manage your money better - if you can always pay back more than you borrowed you. Protect yourself against big losses · Agree between you how much you'll lend them · Discuss interest rates and choose one based on current savings rates · Set a. An Online Platform to Loan Money Worldwide · How Does Pigeon Work? · Getting Started Is Easy · Simple Loans Between Family, Friends, and People You Trust · Ready To. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official. If you want to receive interest, set a fair rate. Treat this as a business transaction; create a payment schedule and get everything in writing. Being the. The statute of frauds mandates that certain agreements must be in writing or they are unenforceable. As a result, a handshake agreement with a friend or. Asking someone if you can borrow or share their resources · Has someone asked you for money or support? · When lending or giving money. Don't do it! Someone who loves you would never want you to put yourself in financial jeopardy to help them. If you loan money to them they are. For small loan amounts under $10,, the answer is simple — no. The IRS isn't concerned with most personal loans to your son, daughter, stepchild, or other. It is not always you are borrowing money from the bank, sometimes you borrow money from your family, or perhaps even lend money to a friend. Considerations when borrowing money for your business from friends or family · Determine if the money is a gift or a loan · A gift for your business from friends. How to say no when family or friends want to borrow money · LISTEN FIRST. If you say no too quickly, your friend or family member might feel ignored, hurt.

Best Way To Cut Credit Card Debt

Once it's paid off, you can roll that payment toward the next-smallest balance. The debt avalanche is the best financial option since you'll save more money on. 1. Assessing Your Current Credit Card Debt Situation · 2. Reducing Spending as Much as Possible · 3. Check Interest Rates and Consolidate Debt · 4. Pay Down Debt. Exceeding your minimum payments each month, targeting one debt at a time to pay off and consolidating debt held across different accounts are all strategies for. 1. Paying only the minimum. The least aggressive debt payoff method is making only the minimum payments. Experts advise you only pay the minimums when your main. How can you reduce credit card debt? You can turn to a variety of strategies to reduce credit card debt, including debt consolidation, balance transfers. Use the debt cascade method if all you can afford right now is the minimum payments on your credit cards. Eventually, the credit card company will lower the. Look for places where you can divert unnecessary spending toward additional debt payments. For example, you might reduce how often you eat out or cancel unused. How do I pay off my credit card debt? · Start by understanding your finances, so you know what you can afford to pay each month. · Use this budget to set aside an. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment. Once it's paid off, you can roll that payment toward the next-smallest balance. The debt avalanche is the best financial option since you'll save more money on. 1. Assessing Your Current Credit Card Debt Situation · 2. Reducing Spending as Much as Possible · 3. Check Interest Rates and Consolidate Debt · 4. Pay Down Debt. Exceeding your minimum payments each month, targeting one debt at a time to pay off and consolidating debt held across different accounts are all strategies for. 1. Paying only the minimum. The least aggressive debt payoff method is making only the minimum payments. Experts advise you only pay the minimums when your main. How can you reduce credit card debt? You can turn to a variety of strategies to reduce credit card debt, including debt consolidation, balance transfers. Use the debt cascade method if all you can afford right now is the minimum payments on your credit cards. Eventually, the credit card company will lower the. Look for places where you can divert unnecessary spending toward additional debt payments. For example, you might reduce how often you eat out or cancel unused. How do I pay off my credit card debt? · Start by understanding your finances, so you know what you can afford to pay each month. · Use this budget to set aside an. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment.

1. Set a Goal Start by Setting a Goal You Can Achieve · 2. Put Your Credit Cards on Ice Yes, We Mean That Literally · 3. Prioritize Your Debts · 4. Trim Your. With a balance transfer credit card, you take your current credit card balance and transfer it to a different card to take advantage of a lower interest rate. How to consolidate credit card debt without hurting your credit · Debt consolidation loan or lower-interest personal loan. With this strategy, you pay off your. Negotiate a better interest rate with your credit card company. Sometimes you can lower your rate by talking to the credit card company. If so, you could save. Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. You might choose to consolidate credit card debts by opening a balance transfer credit card, or you might opt for a debt consolidation loan. Debt consolidation. So you've listed out all your debts and come up with a payment plan that works for your budget. Now it's time to see where you can cut expenses and save some. Secondly reduce the amount of interest you're paying. Call your lenders and ask about getting into a repayment plan or hardship program. Create a Spreadsheet or Chart. Use the following labels for six columns. From left to right: 1. Credit Card Issuer. 2. Interest Rate. 3. Balance. Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. Try to keep your balance low. 3. Pay more than the minimum · Reducing your debt more quickly. Paying more can help cover interest charges and decrease the total balance on your credit card. 1: Cut up the cards. Stop charging purchases, use cash or debit. · 2: Pay more than minimum to just one CC company. this pays that card off early. Credit card debt reduction in 4 easy steps · Call your credit card companies to negotiate lower interest rates. · Revisit your budget to free up as much cash flow. How can you reduce credit card debt? You can turn to a variety of strategies to reduce credit card debt, including debt consolidation, balance transfers. Negotiate a better interest rate with your credit card company. Sometimes you can lower your rate by talking to the credit card company. If so, you could save. Consolidating with a low-interest personal loan from a bank, credit union or credible peer-to-peer source will lower your credit card bill and help you manage. “Don't be shy about asking for help,” Waterman said. “Many credit card companies are willing to work with you when you demonstrate a good faith effort. And this. Use the debt cascade method if all you can afford right now is the minimum payments on your credit cards. Eventually, the credit card company will lower the. Consolidation is another avenue to explore. This option refinances multiple credit card debts into one loan. The new loan should have a lower, more manageable. Trying to eliminate all of your debt? Keeping credit accounts open, and paying the balances in full every month, may help you maintain or increase your credit.

Free Crypto For Signing Up

Okcoin is a secure cryptocurrency exchange which makes it easy to buy Bitcoin, Ethreum, Dogecoin, and other cryptos. New users who open a free Okcoin account. dobrokomp.ru is one of world's most recognized brands in providing or reviewing crypto products and services. We know that a Bitcoin free spins offer is one. BitradePro offers a Crypto No Deposit Bonus $50 USD for new eligible clients who register on the platform to experience global trading. Enjoy a free [ ]. 8 Ways to Earn Free Crypto · 1. Crypto Giveaways · 2. Crypto Referral Programs · 3. Staking or Locking Up Tokens · 4. Airdrops · 5. Faucets · 6. Play Games · 7. If you want to get free crypto - coinbase is the way to go. BUT you need to buy $ of cryptocurrency and then they will just give you $10 worth of BTC. Learn & Earn Reward. Complete quizzes on basic crypto concepts and receive rewards. Courses completed:0/ Learn Now. The Best Crypto Sign-Up Bonus Offers · #1. Gemini · #2. Coinbase · #3. BYDFi · #4. Okcoin · #5. dobrokomp.ru · #6. TradeStation · #7. M2 · #8. Strike. This comprehensive guide delves into the nature of crypto bonuses, highlighting their types, including the increasingly popular no deposit crypto bonuses. Top 10 Crypto Referral Bonuses · Gemini sign up bonus: $10 in BTC · eToro sign up bonus: $30 in cash + extra using Rakuten · Robinhood sign up bonus: free stock. Okcoin is a secure cryptocurrency exchange which makes it easy to buy Bitcoin, Ethreum, Dogecoin, and other cryptos. New users who open a free Okcoin account. dobrokomp.ru is one of world's most recognized brands in providing or reviewing crypto products and services. We know that a Bitcoin free spins offer is one. BitradePro offers a Crypto No Deposit Bonus $50 USD for new eligible clients who register on the platform to experience global trading. Enjoy a free [ ]. 8 Ways to Earn Free Crypto · 1. Crypto Giveaways · 2. Crypto Referral Programs · 3. Staking or Locking Up Tokens · 4. Airdrops · 5. Faucets · 6. Play Games · 7. If you want to get free crypto - coinbase is the way to go. BUT you need to buy $ of cryptocurrency and then they will just give you $10 worth of BTC. Learn & Earn Reward. Complete quizzes on basic crypto concepts and receive rewards. Courses completed:0/ Learn Now. The Best Crypto Sign-Up Bonus Offers · #1. Gemini · #2. Coinbase · #3. BYDFi · #4. Okcoin · #5. dobrokomp.ru · #6. TradeStation · #7. M2 · #8. Strike. This comprehensive guide delves into the nature of crypto bonuses, highlighting their types, including the increasingly popular no deposit crypto bonuses. Top 10 Crypto Referral Bonuses · Gemini sign up bonus: $10 in BTC · eToro sign up bonus: $30 in cash + extra using Rakuten · Robinhood sign up bonus: free stock.

Learn about the top platforms offering the most lucrative free crypto sign up bonuses and kickstart your digital asset journey today! In a Nutshell: Best 12 Free Crypto Sign-Up Bonuses · BYDFi – Complete the First Deposit & Trade to Get USDT. · KuCoin – Earn Up to 11, USDT in Crypto. Each referred friend must be new to Gemini and successfully complete account sign-up using the referral link. After the new user trades $ or more (or USD. dobrokomp.ru is trusted by million+ users worldwide. Trade safely and securely with industry-leading compliance and security certifications today. Get Free Cryptocurrencies Today! FreeCryptoRewards features a wide selection of crypto coins from Bitcoin to Shiba Inu. Name it, and we have it. New crypto projects often distribute free tokens to spread awareness and promote their new cryptocurrency. All you need to do is sign up and. If you want to get free crypto - coinbase is the way to go. BUT you need to buy $ of cryptocurrency and then they will just give you $10 worth of BTC. Get up to $ for getting started Get started with the world's most trusted crypto exchange in under a minute. We use cookies and similar technologies on. Crypto airdrops are a popular method of earning free crypto. These are marketing campaigns drawn up by new crypto platforms to gain visibility and increase. If you've never had an eToro investment account before - open one via our website or mobile apps and you may be offered a $10 crypto bonus. Sign up for free and start earning points right away! Complete simple daily tasks that take less than five minutes, such as watching videos, completing offers. Most free crypto sign-up bonuses require opening an account with a crypto exchange or online stock broker and making a certain deposit. Best Crypto Signup Bonus · Bybit:Upto $30, deposit rewards · M2 Exchange:Claim USDT reward · OKX% off on the trading fee · Kucoin:8, USDT worth of. Click on “Continue as dobrokomp.ru App user” · Confirm your registered dobrokomp.ru App Email and click “Submit” · Check your registered email inbox for a. Sign up on Coinbase and receive up to $ in bonuses and prizes. Follow this Coinbase referral link to activate the deal! Expiration date: 04/09/ 4, Check out these free cryptocurrency promotions to get Bitcoin sign-up bonuses when you try new crypto trading apps that let you buy, sell, store, spend, and. Want to earn some crypto without spending a penny? Free crypto giveaway by dobrokomp.ru is an easy way to win Bitcoin, Ethereum, Uniswap, and other virtual. In this guide, we explain the different types of no deposit crypto bonuses and the art of claiming them. We also unveil our expert picks. Here are a couple of examples of exchanges that offer sign-up bonuses: KuCoin: KuCoin gives users a mystery box worth up to $ for signing up! Coinbase. Trade fee-free on our reliable crypto exchange with the lowest fees, where possibilities to buy, sell, trade, and stake crypto shine like a sunny forecast.

Best Bill Consolidation Companies

Citibank, a large traditional bank with roots dating back to , wins the spot as the best big bank that provides debt consolidation loans. It has a very. A debt consolidation loan combines multiple debts into one payment. A loan can help simplify finances, save money and pay off your debt. Compare top lenders. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. There are several ways to consolidate debt. What works best for you will depend on your specific financial circumstances. These include: Debt consolidation loan. Debt Consolidation Loan Choices. It's best to be sure that consolidating offers you the best benefit financially. Don't just agree to it for the. Consolidating debt can help you simplify and take control of your finances. Combine balances and make one set monthly payment with a debt consolidation. Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. A debt consolidation loan is a type of personal loan that combines high-interest debts and allows for one fixed-interest monthly payment. Research at least three debt settlement companies or attorneys – Clear One Advantage, National Debt Relief and Freedom Debt Relief are the 3 largest – and. Citibank, a large traditional bank with roots dating back to , wins the spot as the best big bank that provides debt consolidation loans. It has a very. A debt consolidation loan combines multiple debts into one payment. A loan can help simplify finances, save money and pay off your debt. Compare top lenders. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. There are several ways to consolidate debt. What works best for you will depend on your specific financial circumstances. These include: Debt consolidation loan. Debt Consolidation Loan Choices. It's best to be sure that consolidating offers you the best benefit financially. Don't just agree to it for the. Consolidating debt can help you simplify and take control of your finances. Combine balances and make one set monthly payment with a debt consolidation. Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. A debt consolidation loan is a type of personal loan that combines high-interest debts and allows for one fixed-interest monthly payment. Research at least three debt settlement companies or attorneys – Clear One Advantage, National Debt Relief and Freedom Debt Relief are the 3 largest – and.

Best for multiple repayment terms: Discover · Best for credit card debt consolidation: Payoff · Best for low interest rate: LightStream · Best for those building. Compare debt consolidation loan rates from top lenders for September ; LightStream · · Loan term. 2 - 7 years ; Upstart · · Loan term. 3, 5. Showing: results for Debt Consolidation Services near USA ; Financial Pathways of the Piedmont, Inc. Credit and Debt Counseling, Debt Consolidation Services. So it's in your best interest to avoid converting your federal student loan debt to private. Always go through the Federal Student Aid program first to see. Top picks from our partners · Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for. Simplify your debt by consolidating multiple loans into one. Learn more about your options for consolidating to lower your monthly payments. Try Upstart! They gave me a decent percentage on a loan when my credit was subpar. Wells Fargo offers the best large debt consolidation loans, giving borrowers up to $,, to be repaid within 12 - 84 months. Wells Fargo has a competitive. Pacific Debt is an accredited member of the Better Business Bureau, stands among the best debt relief companies in the industry. And we're proud to be the top-rated Debt Settlement Company by our clients — with tens of thousands of reviews and testimonials that include: TopConsumerReviews. Achieve is an excellent debt consolidation loan option for those with imperfect credit, thanks to its flexible terms, fast approval, quick funding and. If it's all credit card debt, visit dobrokomp.ru I've used them twice, they lowered all my interest rates under 10% for all my cards and. Some lenders, such as Santander and Zopa, offer loans specifically for debt consolidation. Other providers, like M&S and Halifax, allow you to consolidate your. If you and your counselor decide a debt management plan is best Or, you might take out a personal debt consolidation loan from a bank or finance company. Debt Consolidation Loans for Bad Credit in September ; Upstart logo · · % - % ; prosper logo · · % - % ; upgrade logo · · % -. Prosper is one of the best credit card debt consolidation companies on the market Very quick and easy. Rosalind. Sep 02, I love It. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. Debt Consolidation Loan Lenders ; Lender, Best For, Loan Amounts ; Discover, Overall, $2, to $40, ; Reach Financial, Low rates, $3, to $40, ; SoFi. We'll focus on personal loans. These tend to come with fixed rates, flexible loan amounts and repayment terms up to seven years.

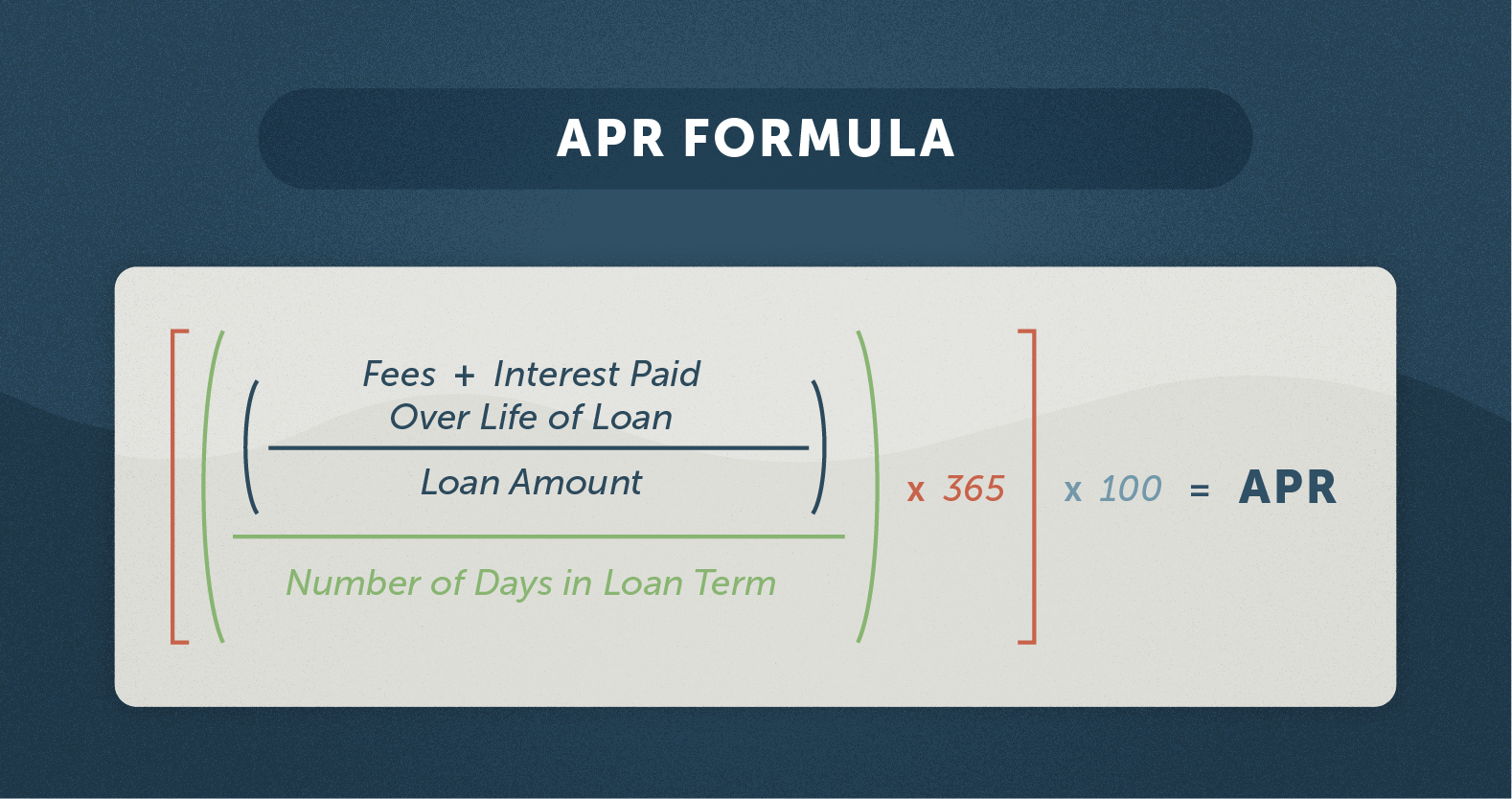

How Does An Apr Loan Work

When you apply for a loan, it's likely that the rate you receive will be based on your personal circumstances. It will take into account your credit history and. The lower your personal loan APR, the less money you'll pay in financing costs over the life of the loan. Read more about how to get a good personal loan rate. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate, however. APR is a way that lenders show the interest and additional charges you will pay on what you're borrowing. What does representative APR mean. It calculates what percentage of the principal you'll pay each year by taking things such as monthly payments and fees into account. APR is also the annual rate. An APR is the interest rate you are charged for borrowing money. In the case of credit cards, you don't get charged interest if you pay off your balance on time. APR represents the price you pay for a loan. · APR can sometimes be the same as a loan's interest rate, like in the case of most credit cards. · APR may be fixed. How Is APR Calculated for Loans? A loan's APR is calculated by determining how much the loan is going to cost you each year based on its interest rate and. The APR expresses the total cost of borrowing which may differ among lenders based on how they set their rates, and the fees they charge. Your credit score and. When you apply for a loan, it's likely that the rate you receive will be based on your personal circumstances. It will take into account your credit history and. The lower your personal loan APR, the less money you'll pay in financing costs over the life of the loan. Read more about how to get a good personal loan rate. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate, however. APR is a way that lenders show the interest and additional charges you will pay on what you're borrowing. What does representative APR mean. It calculates what percentage of the principal you'll pay each year by taking things such as monthly payments and fees into account. APR is also the annual rate. An APR is the interest rate you are charged for borrowing money. In the case of credit cards, you don't get charged interest if you pay off your balance on time. APR represents the price you pay for a loan. · APR can sometimes be the same as a loan's interest rate, like in the case of most credit cards. · APR may be fixed. How Is APR Calculated for Loans? A loan's APR is calculated by determining how much the loan is going to cost you each year based on its interest rate and. The APR expresses the total cost of borrowing which may differ among lenders based on how they set their rates, and the fees they charge. Your credit score and.

The Annual Percentage Rate (APR) is the yearly rate of interest that an individual must pay on a loan or that they receive on a deposit account. If you're shopping for a loan or credit card, you may notice something called the annual percentage rate (APR). APR represents the annual cost to borrow. It's calculated by considering the loan amount, interest rate, and any additional charges over the loan term. By comparing APRs from different lenders. How does APR work and how to calculate it? APR is the annual cost of the loan expressed as a percentage. It includes the interest rate and other costs of. The annual percentage rate (APR) is the cost of borrowing on a credit card. It refers to the yearly interest rate you'll pay if you carry a balance, plus any. The APR is the cost to borrow money as a yearly percentage. It's a more complete measure of a loan's cost than the interest rate alone. It includes the interest. Interest rate is the percentage lenders charge for borrowing money. Meanwhile, the APR provides a more comprehensive view of how much you'll pay annually for. In contrast, the APR encapsulates the comprehensive annual cost of a loan, incorporating fees and additional expenses, also depicted as a percentage. Typically. The most common and comparable interest rate is the APR (annual percentage rate), also called nominal APR, an annualized rate which does not include compounding. The (effective) APR has been intended to make it easier to compare lenders and loan options. "How Do Small-Dollar, Nonbank Loans Work?". SSRN. doi/. It is the minimum interest that a borrower would pay if they took out a loan at the start of the year, the bank calculated the interest to be. How does an APR work? APR stands for Annual Percentage Rate and it represents the yearly cost of borrowing money. It includes the interest rate that applies. What is APR and how does it work? When you borrow money, you usually have to pay back the original amount plus an additional percentage of the loan amount as. How do I find out what my total APR is? An APR can be calculated by multiplying a monthly percentage by If a loan charges 12% a month, the APR will be %. The Annual Percentage Rate (APR) is the yearly rate of interest that an individual must pay on a loan or that they receive on a deposit account. Both the interest rate and the APR on a loan reflect the cost to borrow money from a lender for a specified period of time. However, they differ in how they are. How does a credit card's interest rate and APR Work? Ever wondered what APR means and why it's plastered everywhere on a credit card application? This small. Cash advance APR: This APR is charged when you write a check from your credit card account or use your card to draw cash from an ATM. “Usually a cash advance. If you're shopping for a loan or credit card, you may notice something called the annual percentage rate (APR). APR represents the annual cost to borrow. The APR is typically used to describe interest rates on loans, credit cards, and other forms of credit. It helps you calculate how much extra you'll pay to.

1 2 3 4 5